A Biased View of Final Expense In Toccoa, Ga

Wiki Article

The 10-Second Trick For Life Insurance In Toccoa, Ga

Table of ContentsUnknown Facts About Health Insurance In Toccoa, Ga5 Simple Techniques For Medicare/ Medicaid In Toccoa, GaFacts About Life Insurance In Toccoa, Ga UncoveredExamine This Report about Life Insurance In Toccoa, GaHow Automobile Insurance In Toccoa, Ga can Save You Time, Stress, and Money.The Ultimate Guide To Final Expense In Toccoa, Ga

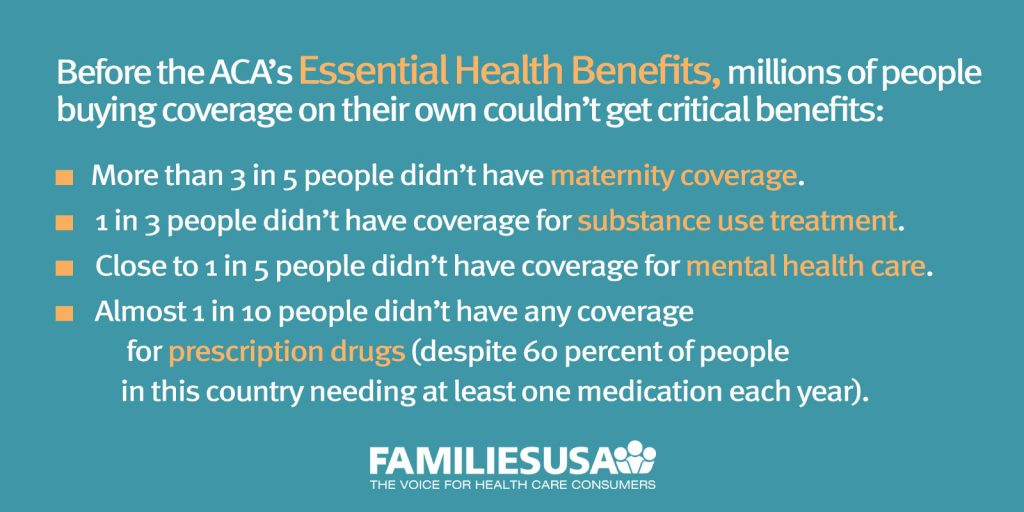

Learn just how the Affordable Treatment Act(Obamacare)enhanced individual wellness insurance coverage and provided plan price via subsidies, Medicaid expansion and various other ACA arrangements. These options can consist of clinical, dental, vision, and more. Find out if you are eligible for coverage and sign up in a strategy through the Marketplace. See if you are qualified to make use of the Medical insurance Market. There is no income restriction. To be eligible to sign up in health and wellness coverage with the Marketplace, you: Under the Affordable Treatment Act(ACA), you have unique individual protection when you are guaranteed via the Health and wellness Insurance Market: Insurance companies can not refuse protection based upon gender or a pre-existing problem (Home Owners Insurance in Toccoa, GA). https://comicvine.gamespot.com/profile/jstinsurance1/. The healthcare legislation uses legal rights and protections that make coverage extra reasonable and simple to comprehend. Some rights and protections relate to strategies in the Health and wellness Insurance Coverage Industry or other individual insurance, some relate to job-based plans, and some put on all health and wellness protection. The protections laid out listed below may not relate to grandfathered health and wellness insurance coverage plans.With clinical prices skyrocketing, the demand for exclusive health insurance in this day and age is a monetary reality for several. Health and wellness insurance coverage is the primary car that many consumers make use of to spend for clinical and medical facility expenses. There is public wellness insurance such as Medicare and Medicaid, which some may get depending upon age, revenue and family members dimension. Within the group of personal wellness insurance, there are significant differences between a wellness managed organization (HMO)and a favored provider organization(PPO)plan. Depending upon the sort of exclusive health insurance you choose, there will certainly be certain benefits and limitations. While many economic planners will motivate you to bring a type of personal coverage, it can come with some downsides that need to be considered when you acquire a plan. By doing this, treatment is collaborated with your PCP.When thinking about if an HMO is best for you, here are some things to think of: HMOs typically set you back much less than PPOs. An HMO may be a good option if you do not have lots of health and wellness issues and for that reason little need to visit professionals and/or if you do not mind collaborating care through your PCP. A PPO includes a network of doctor with both health care and experts

PPOs provide higher versatility than HMOs due to the fact that a reference is not required to see an expert. You might additionally see companies out of network, though you will certainly need to pay greater copays to do so. Keep in mind the following when deciding if a PPO is the very best choice for you. PPOs are generally a lot more expensive than HMOs. PPOs might provide even more versatility if you discover yourself looking for specialists 'treatment or already have physicians that you intend to see, also if they are not in-network. Of course, one of the most obvious benefit is that private health and wellness insurance coverage can provide protection for several of your health care expenditures. This might permit you to choose the alternatives that you are most likely to need and leave out those that you don't . The experiences that include exclusive medical insurance could include much shorter delay times, greater personalized focus and more advanced centers. Public facilities can be jammed at times and may provide a reduced level of treatment in a lot of cases. This is particularly real if you are in poor health and wellness and do not have accessibility to group insurance coverage of any kind.

Little Known Facts About Affordable Care Act (Aca) In Toccoa, Ga.

Lots of specific policies can cost a number of hundred bucks a month, and family members coverage can be even higher. And also the extra comprehensive policies included deductibles and copays that insureds have to meet before their coverage begins.

The majority of wellness strategies have to cover a collection of preventative solutions like shots and screening tests at no charge to you. This includes plans readily available through the Health and wellness Insurance Coverage Market. Notice: These solutions are free just when supplied by a physician or other company in your plan's network. There are 3 collections of complimentary precautionary services.

How Health Insurance In Toccoa, Ga can Save You Time, Stress, and Money.

When you get insurance, the regular monthly costs from your insurer is called a costs. Insurer can no more charge you a higher costs based upon your health condition or as a result of pre-existing medical conditions. Insurer offering major medical/comprehensive policies, set a base price for every person who purchases a medical insurance plan and after that change that price based on the factors listed below.Generally, there is a tradeoff in the costs quantity and the costs you pay when you receive treatment. The higher the month-to-month costs, the reduced the out-of-pocket prices when you receive care.

To find out more on kinds of health and wellness insurance policy, call your company advantage rep or your economic specialist. In recap, below are several of the pros and disadvantages of making use of exclusive medical insurance. Pros Numerous alternatives so you can select the most effective strategy to satisfy your private requirements Typically provides greater flexibility and accessibility to care than public wellness insurance policy Can cover the price of costly healthcare that might arise unexpectedly Cheats Pricey with costs increasing each year Does not guarantee full accessibility to care If you want to find out more about conserving for medical care or exactly how healthcare can impact your family members budget plan, check out the Protective Understanding Facility.

The Of Annuities In Toccoa, Ga

Many health plans should cover a collection of preventive services like shots and testing tests at no cost to you. This consists of plans available through the Wellness Insurance Policy Industry.When you get insurance, the month-to-month expense from your insurance firm is called a premium. Insurance policy companies can no much longer charge you a greater premium based upon your health standing or because of pre-existing clinical conditions. Insurance provider supplying major medical/comprehensive plans, set a base price for everyone who acquires a medical insurance plan and afterwards adjust that price based upon the elements listed here.

Typically, there is a tradeoff in the costs quantity and the costs you pay when you get treatment. The higher the regular monthly costs, the lower the out-of-pocket costs when you receive treatment.

5 Easy Facts About Home Owners Insurance In Toccoa, Ga Described

The majority of health insurance plan have to cover a set of preventive solutions like shots and screening examinations at no expense to you. This consists of strategies available with the Medical insurance Marketplace. Notification: These solutions are totally free only when supplied by a doctor or other service provider in your strategy's network. There are 3 collections of cost-free preventative services.

When you purchase insurance, the month-to-month costs from your insurance coverage business is called a premium. Insurance provider can no more charge you a greater premium based on your wellness condition or due to pre-existing clinical conditions. Insurance firms using major medical/comprehensive plans, set a base price for everybody who acquires a medical insurance strategy and afterwards readjust that rate based upon the aspects listed below.

Not known Facts About Life Insurance In Toccoa, Ga

Usually, there is a tradeoff in the costs amount and the costs you pay when you receive treatment - Final Expense navigate to this website in Toccoa, GA. The higher the month-to-month costs, the lower the out-of-pocket prices when you obtain careReport this wiki page